CIRCULAR STARTUP TOKYO is an incubation program dedicated to supporting startups in the circular economy sector. Over a five-month period, participants receive mentoring from entrepreneurs and experts active in the circular economy, attend lectures on circular business, and have networking opportunities with domestic and international circular economy promotion organizations, major corporations, financial institutions, investors, local governments, and specialists. The program aims to assist participants in building and growing new business models that contribute to the realization of a circular economy, ultimately aiming to secure funding and generate social impact.

On December 23, 2024, the program hosted the fifth session of the Circular Business Design Lecture and the fourth session of Circular Economy Startup Practice. The theme was “Circular Economy and Finance.” The speakers were:

- Hirokazu Kitahara, Partner at Archetype Ventures, an independent venture capital firm.

- Satoshi Nakamura, Senior Associate at Archetype Ventures.

- Yuuki Yoshimoto, CEO of Sotas Co., Ltd., a company working to realize a circular economy through a material platform specialized in the chemical industry.

In the first half of the lecture, Nakamura introduced fundamental concepts of fundraising and common discussion points among investors in the circular economy sector. Kitahara then provided insights into the funding environment surrounding startups in this field.

In the second half, focusing on circular economy and startup practices, Yoshimoto spoke about Sotas’ business and shared insights into what happened behind the scenes during their successful fundraising efforts.

This article provides an excerpt of the lecture.

*About the Circular Business Design Lecture

The Circular Business Design Lecture consists of five sessions. The first session provides a broad perspective on system design before progressively narrowing its focus to business design, service design, and product design in later sessions, delving deeper into the process of building circular businesses.

The Importance of Business Background and Economic Viability in Fundraising

Fundraising is a critical step for any startup looking to scale its business. According to Nakamura from Archetype Ventures, the most important factor for startups when considering fundraising is “understanding exactly how much capital their business truly needs.” This principle applies equally to startups in the circular economy sector.

Nakamura: “Broadly speaking, businesses can be categorized into two types: those that gradually generate profits over time and those—often referred to as startups or ventures—that initially operate at a loss but aim for rapid growth later on.”

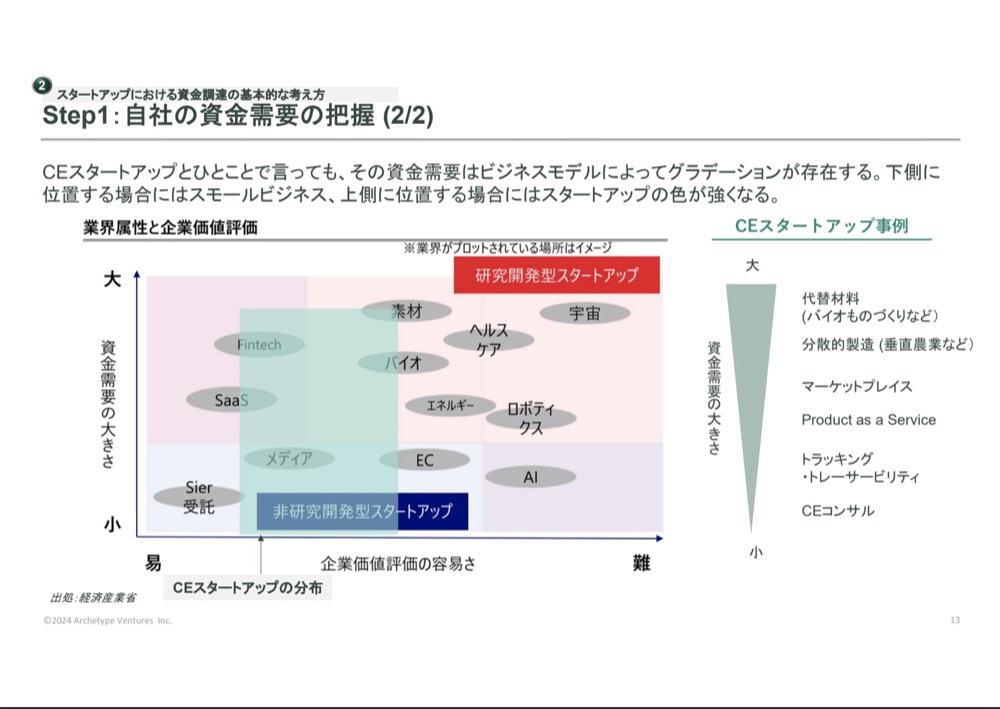

There are clear differences in the characteristics and capital needs between these two business models. For example, industries like space technology and biotechnology require significant capital for R&D and infrastructure. In contrast, contract-based business models, where products are developed and delivered upon request, typically have lower capital requirements.

The circular economy sector includes a wide range of business models, such as:

- Developing alternative materials or biotech products, which require substantial capital due to the need for specialized equipment and infrastructure.

- Consulting on circular economy practices or businesses focused on data tracking and traceability, which generally require less capital.

Thus, it is essential for startups to accurately assess their business characteristics and capital needs to develop an effective fundraising strategy.

Image via Archetype Ventures

Nakamura highlighted four critical factors that startups in the circular economy should focus on when raising capital:

1.Background of the startup

“Investors place significant importance on the motivation behind a startup’s founding. In highly visible sectors like the circular economy, answering the question, ‘Why start a business in this field?’ is crucial. Investors want to determine whether the founder possesses the passion and perseverance to see their vision through.”

2.Economic viability

While environmental objectives, such as CO2 reduction, are essential, a business must also demonstrate a fundamental level of economic sustainability to be viable. Startups must clearly articulate the economic rationale behind these goals and how they contribute to a financially sustainable business model.

3.Competitive advantage

- In hardware and R&D-intensive fields, technological superiority can be relatively straightforward to demonstrate.

- However, in areas like traceability within the circular economy, articulating a clear competitive advantage can be more challenging.

Nakamura stressed: “No single company can realize a circular economy alone. The key is demonstrating the ability to engage key players early in the process. This ability to build strategic partnerships is particularly critical in this sector.”

4.Market size

Investors acknowledge the vast potential of the circular economy market, but they are also highly focused on the specific market size that a startup is targeting.

- Startups must provide a reasonable and well-founded projection of their Serviceable Obtainable Market (SOM)—how much revenue they can realistically expect to generate and from how many customers or users.

- Demonstrating that the SOM is sufficiently large is a crucial factor in attracting investors.

Through this lecture, it became evident that successful fundraising in the circular economy sector requires a well-balanced approach that integrates both environmental impact and economic viability.

Satoshi Nakamura, Senior Associate at Archetype Ventures LLC

Cultural and Perceptual Differences Necessitate a Global Perspective from the Outset

Hirokazu Kitahara from Archetype Ventures provided insights into the current funding landscape for startups in the circular economy sector.

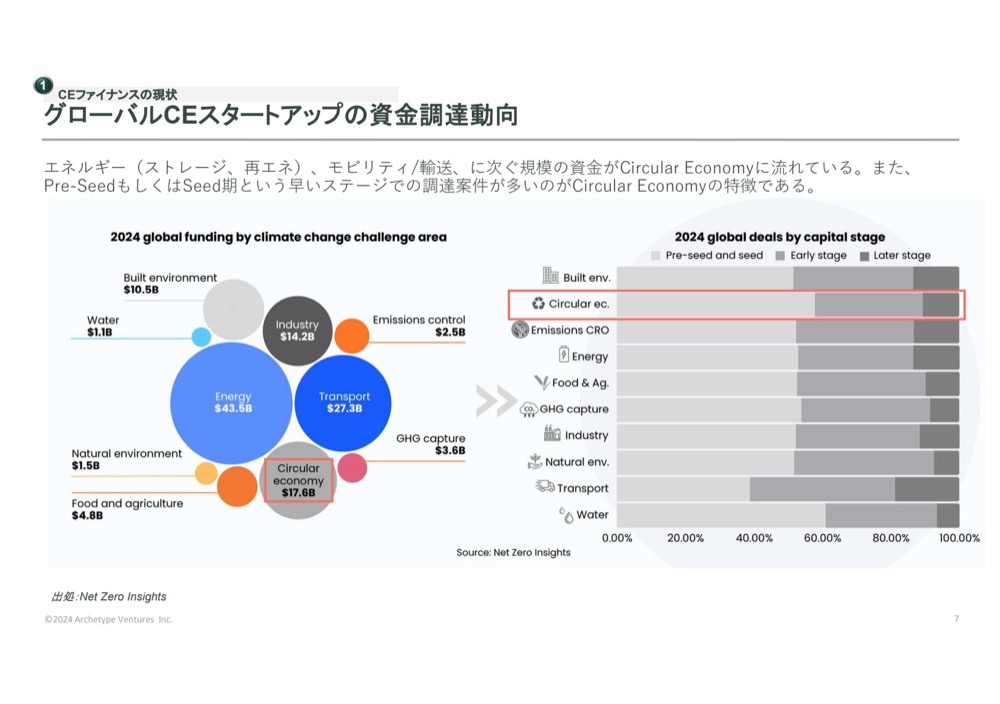

Currently, there are no dedicated indicators specifically measuring the investment environment for the circular economy. However, Kitahara noted that its scale can be inferred from trends in climate tech and digital sectors.

Kitahara: “Within the broader investment landscape related to climate change, the circular economy is gaining traction, following the energy and transportation sectors. Additionally, investment activity is predominantly focused on early-stage startups, suggesting that this sector still holds substantial growth potential.”

Stocks classified under the circular economy sector, as selected by HolonIQ from the U.S. market, have outperformed both the S&P 500 and the Dow Jones Industrial Average.

However, Kitahara underscored the importance of crafting a compelling equity story to persuade domestic investors who have yet to fully embrace the circular economy.

“While the circular economy presents vast growth potential, success depends not only on projected market size but on developing a realistic and effective business model,” Kitahara emphasized.

Image via Archetype Ventures

Building on this point, Kitahara emphasized the importance of adopting a global perspective to achieve successful fundraising.

Kitahara: Japanese startups tend to focus heavily on the domestic market and often lack a global outlook. In the circular economy sector, consumer perceptions, cultural norms, and sensibilities vary significantly by region, requiring businesses to develop products tailored to these differences.”

For instance, while the IT sector also requires localized adaptations for different markets, the circular economy sector is even more susceptible to cultural influences. For example, waste separation awareness is highly developed in Japan. However, designing products based on this assumption may not lead to the same level of acceptance in international markets.

Therefore, it is essential to develop products that can gain broad acceptance beyond domestic borders. Even if a business begins in Japan, it must consider international market conditions from the outset and plan for global expansion accordingly.

Hirokazu Kitahara, Partner at Archetype Ventures LLC

Key to Successful Seed Funding: Reflecting on Life Choices and Clearly Articulating the Reason for Entrepreneurship

In the second half of the session, Yuuki Yoshimoto, CEO of Sotas Co., Ltd., introduced the company’s business and shared insights from his own fundraising experience on what is essential for securing investment.

Sotas (*The links in the text are written in Japanese.) is a startup with a mission to extend the planet’s lifespan by maximizing the circularity and liquidity of materials. The company has built a digital platform specializing in the chemical industry, transforming unstructured data into structured data to enhance traceability and efficient material management. Through this approach, Sotas aims to contribute to a global circular economy.

The company’s core strength lies in its focus on the chemical industry’s material data market, which is estimated to be worth 600 trillion yen. By leveraging digital technology to optimize the inefficient supply chain, Sotas provides SaaS (Software as a Service) solutions as the foundation of its business. This approach enables the company to accumulate data from user companies and offer more advanced services over time.

*An abbreviation for “Software as a Service,” SaaS refers to a software delivery model where applications are provided over the internet.

Sotas’ products include “Sotas Process Management,” “Sotas Database,” and “Sotas Chemical Research.” (As of February 2025)

In October 2024, Sotas raised approximately 480 million yen. (*The links in the text are written in Japanese.) Yuuki Yoshimoto highlighted three key factors that contributed to securing the seed funding:

1.Assessing the market size (TAM, SAM, SOM)

Understanding Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) is crucial for any service. A clear grasp of market size is essential for attracting investors and demonstrating growth potential.

2.Answering “Why now?”It is vital to thoroughly analyze and articulate why now is the right time for the business to succeed. A well-structured explanation of the timing can significantly influence investors’ confidence in the venture.

3.Reflecting on life choices and the motivation for entrepreneurship

Yoshimoto shared an experience where a prominent investor once asked him: “Why do you want to start a business?” and “What life choices led you to this point?” This underscores the importance of convincingly explaining why one is dedicating their limited time to entrepreneurship and how past experiences have shaped this decision.

Yoshimoto: “It’s beneficial to reflect on why you want to start a business despite life’s limited time and how your career and past decisions have led you to this point.”

Yuuki Yoshimoto, CEO of Sotas Co., Ltd.

Conclusion

From the insights shared by the three speakers, it became clear that staying true to one’s original vision while simultaneously crafting a well-structured plan for market size and business expansion is essential for securing funding and achieving further growth.

The next session will feature an intensive academic lecture by experts in environmental science and design. Participants will deepen their understanding of circular economy and product design, equipping themselves for business expansion and Demo Day. We eagerly anticipate the progress of each participant!

Lecture in progress